WHY INSURANCE AGENCY

The top benefits of being an insurance agent :

For example, insurance can pay to rebuild a home after a fire, provide for loved ones after a death, or help workers injured on the job. By encouraging individuals to share risk, it protects each of those individuals if tragedy strikes. In addition, insurance companies are often active and engaged members of their communities. Many agencies are involved in a variety of charitable efforts, such as local children’s organizations, animal shelters, disaster relief, and more.

- Communication

- Technology

- Problem-solving

- Research

- Analytics

- Organization

There are a wide variety of roles in insurance, and some are incredibly easy to jump right into. To begin a career as an insurance agent, all you need is a high school diploma or equivalent – no work experience required. And the whole process of becoming an agent can take as little as a few weeks. However, you’ll need to choose your specialty and also get your license. Learn more about how to become a licensed insurance agent, and get started on a rewarding career.

Benefits Of Insurance Agency

Why From SANJAY BIDANI

Mr Sanjay Bidani a leading Sr Business Associate (Development Officer) LIC of India and founder of Team Smriddhiworking since 1988 and having team of 114 Professional advisors. His team always breaks records and technically very sound. We adapt technology very fast and we believe to educate every team members in depth by trainings physically remotely and virtually. Mr Bidani believes in solution not in selling so most of the members specially members of Junoon group are Pension and Child future planner. Become a member of Team Smriddhi every member earn while learn.

Procedure To Become An Agent:

1.Simple Registration Process: To become an LIC agent, you have to fill in a simple registration form available on the Contact Us page of our website. You can submit the documents mentioned at the bottom of this page later. Please also take a look at the Documents and Fees section of this page.

2.Online or Offline Training: Once you are through the registration process, you will have to go for Online or Offline Training of 25 hours. Upon completion of the training, you will be awarded with a training certificate. The training covers all the aspects of Life Insurance Business.

3.Examination: Further, you will appear a Pre-Licensing Online exam conducted by IRDA and obtain at least – 17 out of 50 Marks. The questions will be of objective type.

4.Appointment Letter: Upon passing the exam, you will be awarded a license by IRDA to work as an insurance agent. Then you will be appointed as an agent by our branch and now you will be a part of a team.

What To Do Next:

- Attend subject oriented training sessions conducted by the Development officer Sanjay Bidani every month.

- Start with procuring business from known circle before venturing into unknown circle.

- Focus on your core competence area- Salary saving scheme, employer-employee module, keyman, term insurance, pension plans, bima school, bima gram, MWP etc..

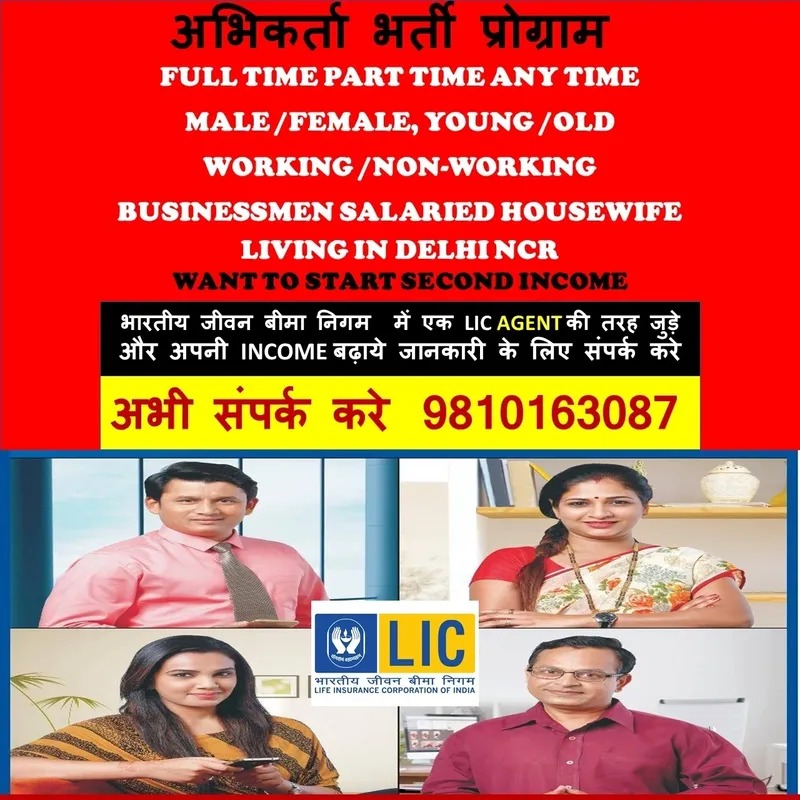

Who Can Become An Agent/Advisor:

- Doctors- MBBS, Homeopaths, Ayurveda, Unani, RMPs.

- Engineers– BE, BTECH, Diploma holders.

- Lawyers

- Chartered Accountants

- Govt Employee’s spouse and children.

- CEOs of Companies.

- Builders, Contractors.

- Salaried persons looking for an extra income.

- Contract employees of govt, quasi govt, LIC HFL, anganwadi workers.

- Teachers, Nurses.

- Medical representatives, Salesmen, Marketting personnel.

- Students-boys and girls.

- Housewives

- Stock brokers

- Estate Agents

- Retired/VRS employees.

- Skilled/Semi skilled Labour, Artisans-goldsmith, blacksmith, potters, tailors etc.

- General insurance agents, health insurance agents and Pharma distributors.

- Other company insurance advisors.

- Software professionals, medical transcriptionists etc willing to expand or build their social network.

Qualities Needed To Become An Agent/Advisor:

- Quest for earning.

- Urge to work.

- Strive to gain knowledge.

- Positive approach to life.

- Friendly Disposition.

- Social responsiveness towards others welfare.

- Integrity in Professional and Personal aspects.

Your Role As An Agent:

- Share financial vision of customers.

- Educate on diversification of funds- savings, insurance, loans etc.

- Guide/ Suggest customers on investment avenues.

- Accountable for customers trust in you.

- Become a part of many families that you serve.

- Contribute your might to society in a meaning way.

Eligibility :

- Minimum Educational Qualification : (10th Pass).

- Minimum Age: 18 Years (No Upper Age Limit).

- Resident of Noida And Delhi (NCR)